Best Crypto Debit and Credit Cards of 2025

Last updated: 03/09/2025

Discover the best crypto debit cards, offering easy spending, security, rewards, and seamless transactions for crypto users.

Disclosure: To maintain the operation of our site free of charge, we may occasionally earn a small commission if a reader chooses to purchase services through links on our site, at no extra cost to them. Read about disclosure here

What Are Crypto Debit Cards?

Crypto debit cards are payment cards that allow you to spend your cryptocurrency holdings in the real world, just like a traditional debit card. These cards work by converting your cryptocurrency into fiat currency (like USD, EUR, etc.) at the point of sale, enabling you to make purchases at any retailer that accepts debit card payments.

They bridge the gap between the digital and physical economies, letting you use assets like Bitcoin, Ethereum, and other cryptocurrencies for everyday transactions. Some crypto debit cards also offer additional features like cashback, rewards, and lower fees, making them a convenient tool for crypto users looking to spend their digital assets seamlessly.

Different Types of Crypto Cards

Crypto cards come in various forms, each offering unique features and benefits to suit different user needs. Here are the most common types:

Prepaid Crypto Cards

These cards are preloaded with a specific amount of cryptocurrency, which can be spent like a regular debit card. They are ideal for users who want to control how much crypto they spend.

Crypto Debit Cards

These cards are connected directly to your crypto wallet, enabling you to spend your assets instantly. When you make a purchase, your cryptocurrency is converted to fiat currency at the time of the transaction.

Crypto Credit Cards

Similar to traditional credit cards, these cards let you borrow funds based on your credit limit. Some crypto credit cards offer rewards in cryptocurrency, making them popular for frequent crypto users.

Virtual Crypto Cards

These are digital-only cards, often used for online purchases. They allow you to spend cryptocurrency without the need for a physical card.

Metal Crypto Cards

These premium cards are made from metal and typically offer higher rewards, lower fees, and exclusive perks, like airport lounge access or concierge services, often reserved for higher-tier users.

How Do Crypto Cards Work?

Crypto cards function similarly to traditional debit or credit cards, but with a key difference — they allow you to spend cryptocurrency at everyday merchants.

Link to Your Crypto Wallet

To use a crypto card, you first connect it to your cryptocurrency wallet. This wallet holds the digital assets (Bitcoin, Ethereum, etc.) that you’ll use to fund transactions.

Convert Crypto to Fiat

When you make a purchase with a crypto card, the card provider automatically converts your cryptocurrency into fiat currency (like USD, EUR, or GBP) at the current exchange rate. This allows you to shop at any merchant that accepts card payments, just like you would with a traditional debit or credit card.

Make Payments

You can use your crypto card for both in-store and online purchases, and the conversion happens in real time, so you don’t need to manually exchange your crypto for fiat before making a transaction.

Fees and Rewards

Many crypto cards come with associated fees, including transaction or conversion fees, and some may offer rewards in the form of cryptocurrency or cashback on purchases.

In short, crypto cards simplify spending your digital assets in the real world by handling the conversion from crypto to fiat seamlessly during each transaction.

Best Crypto Cards

Are you a cryptocurrency enthusiast looking for an easy way to spend your digital assets in the real world? If so, a crypto debit card could be the solution you’re looking for.

Top crypto platforms like Coinbase, Bybit, Nexo, Crypto.com, and (formerly) Binance offer these cards, and based on feedback from current users, I’ve narrowed down the best options available. In this guide, I’ll walk you through each platform and explain why these cards might be a great choice if you’re looking to use your crypto in everyday transactions.

Each type of crypto card has its own features and use cases, so choosing the right one depends on how you intend to spend your crypto and the benefits you’re looking for.

Here are the best crypto debit cards we’ll be covering:

Start Now!

The Bybit Card is a crypto debit card provided by Bybit, a leading centralized cryptocurrency derivatives platform. This custodial card offers a range of benefits, including no staking requirements, making it an attractive option for crypto users.

Features

The Bybit Card is a Mastercard debit card that provides users with easy transaction management through a dedicated dashboard on both the Bybit web platform and mobile app. Key features of the card include:

1. Supports a variety of cryptocurrencies, including BTC, ETH, XRP, USDT, and USDC.

2. Loyalty rewards with points that can be redeemed for vouchers or cryptocurrencies, along with up to 10% cashback on eligible purchases.

3. An Auto-Savings feature that enables users to earn interest on assets held in Flexible Savings, which can be unstaked and spent at any time.

4. Works with Google Pay and Apple Pay for seamless digital payments.

Available exclusively to users in Australia and the European Economic Area (EEA).

The Bybit Card combines convenience, rewards, and flexibility, offering a robust solution for crypto users looking to spend and manage their assets in real-time.

Cost and Fees

Bybit’s crypto card has no annual or hidden fees, but there are a few charges to be aware of:

Foreign exchange fee: 0.5% in addition to Mastercard’s exchange rate.

Crypto conversion fee: 0.9%, plus any spot market fees.

The virtual Bybit card is free, while the physical card comes with a fee of 5 EUR/GBP/USDT. ATM withdrawals are free for up to 100 EUR/GBP per month; a 2% fee applies on amounts exceeding that limit.

Spending limits are as follows:

Daily: 5,000 EUR/GBP

Monthly: 50,000 EUR/GBP

Annually: 250,000 EUR/GBP

These fees and limits ensure flexibility for users while maintaining transparency in card usage.

How can I apply for a Bybit Debit Card

You might be wondering, How can I apply for a Bybit debit card?” The process is actually quite straightforward! Here’s how to do it:

Step 1: Make sure you meet the following requirements to apply for a Bybit card:

Your Bybit account is linked to both an email address and a mobile number.

You’ve enabled Google Two-Factor Authentication.

You’ve completed KYC (Know Your Customer) by submitting proof of identity and proof of address.

For the identity verification, you’ll need either your National ID or Passport. Note that Bybit cards are available only to residents of Australia and countries within the European Economic Area (EEA). So, if you’re looking for an anonymous crypto debit card, this might not be the right option for you.

Step 2: Once you’ve met all the requirements, you can apply for the Bybit card via the website or through the Card Application on your mobile. For a detailed guide, head over to Bybit’s website for a step-by-step tutorial!

Once your account is verified, you can quickly deposit your digital assets and start using your card for everyday transactions!

You can begin using your virtual crypto debit card immediately after verification. However, if you’d like to receive a physical card, there’s a small issuance fee of 5 EUR/GBP/USD/USDT. Once the fee is paid and your application is complete, you’ll receive your physical card within 30 days.

That’s all there is to it! In summary, Bybit’s debit card is a great choice for anyone seeking a secure, flexible, and rewarding crypto debit card. With no transaction fees, an easy-to-use interface, and a generous rewards program, it’s no surprise that it’s widely regarded as one of the best crypto debit cards available.

The Coinbase Card is a debit card created by one of the world’s largest cryptocurrency exchanges, enabling users to make payments directly from their Coinbase account balances in crypto. What sets the card apart is its ability to earn crypto rewards on everyday purchases.

Features

The Coinbase Card is a Visa debit card with a range of features, including:

Support for eight cryptocurrencies, such as Bitcoin (BTC), Ether (ETH), Dogecoin (DOGE), and more.

1. Earn cashback rewards in cryptocurrency.

2. Accepted anywhere Visa debit cards are used.

3. No spending or annual fees.

4. Strong security features, including two-factor authentication, card freezing, and PIN management.

5. Available in Europe, the UK, and the US.

Cost and Fees

The Coinbase Card comes with no annual or spending fees, making it an affordable choice for users. However, network transaction fees (such as gas fees) still apply when transferring cryptocurrency off the platform, and these fees are clearly disclosed during the transaction.

Additionally, fees for buying, selling, or converting cryptocurrencies on Coinbase vary based on factors like payment method and order size. While there are no transaction fees for using the Coinbase Card, ATM operators may charge fees for withdrawals.

The card also offers flexible funding options, allowing users to link their bank accounts or deposit a portion of their paycheck into Coinbase without any fees. The setup process is simple, with no credit check required and no need to stake assets to qualify.

The Binance Card is a crypto debit card that allows users to spend digital assets anywhere Visa is accepted. It supports multiple cryptocurrencies, including BTC, ETH, and BUSD. With low fees, cashback rewards up to 8%, and top-notch security features, it’s a great option for convenient crypto spending.

Features

The Binance card might not be the “best crypto credit card” since it isn’t actually a credit card, but it certainly ranks among the top crypto debit cards available. Its backing by Binance, one of the leading global crypto exchanges known for offering a wide range of services, supporting popular cryptocurrencies, and maintaining robust security, is a strong reason for its appeal.

Available as both a virtual and physical card, the Binance card lets you make purchases with either fiat or crypto at over 90 million merchants worldwide that accept Visa. You can also link it to Google Pay or Samsung Pay for added convenience.

The card is currently available in the EEA, Argentina, Bahrain, Brazil, Colombia, the GCC, Peru, and Mexico, and supports fiat currencies like EUR, USD, ARS, BRL, COP, PEN, and MXN. Expect the list of supported countries and currencies to expand in the future.

Cost and Fees

The cryptocurrencies supported by the Binance card vary depending on the country of issuance, but all cards include popular assets such as BTC, ETH, BNB, USDT, and BUSD.

One of the key advantages of the Binance card is the ability to earn up to 8% cashback in BNB on purchases made with either crypto or fiat. BNB, Binance’s native token, has a range of uses, including discounts on trading fees.

Another notable benefit is that the Binance card comes with no ATM withdrawal fees, no foreign exchange fees, and no annual fees. Plus, you don’t need to pre-convert your crypto before using it. All funds are also secured with strong security measures.

In fact, the Binance card could even be considered superior to many so-called “best crypto credit cards.” It not only rewards you with crypto (BNB) for spending but also makes using crypto as seamless and straightforward as using fiat currency.

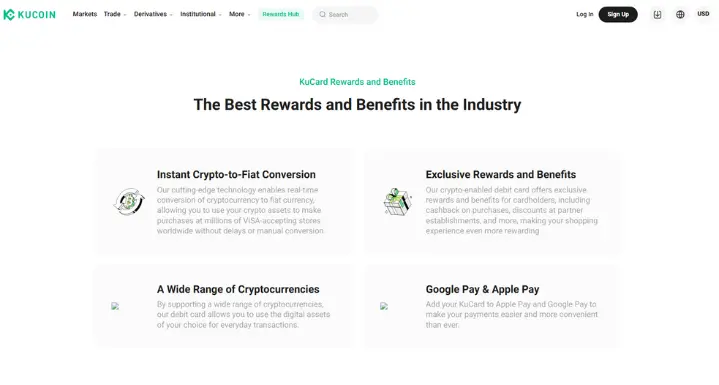

The KuCoin Card is a Visa debit card that allows users to spend their cryptocurrency anywhere Visa is accepted. It supports a range of digital assets, including USDT and EUR, with plans to add more currencies in the future. Users can earn up to 4.7% cashback on purchases in various cryptocurrencies like BTC, ETH, and KCS. The card also offers additional benefits like access to airport lounges and discounts. With customizable spending limits, and support for Apple Pay and Google Pay, the KuCoin Card is a flexible and secure option for crypto enthusiasts. Available to residents in select EEA countries.

Features

Cashback: Up to 4.7%

Fees: €9.99 issuance fee, 2% foreign transaction fee (for non-euro transactions), €1.50 euro withdrawal fee, 2% non-euro withdrawal fee, and €10 annual maintenance fee.

Eligibility: Available to residents of Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Iceland, and Norway.

1. Did you know that KuCoin, one of the largest cryptocurrency exchanges, has launched its own debit card, KuCard? If you didn’t, now is the perfect time to get acquainted with it! KuCard is quickly becoming one of the top crypto debit cards on the market.

2. The KuCoin debit card is a Visa card that lets users spend their crypto assets anywhere Visa is accepted, offering a seamless way to convert crypto into fiat and make purchases both online and offline.

3. With the KuCoin app, managing your funds and tracking your spending is simple and convenient.

As for fees, there are no cancellation or euro transaction fees. However, the card does carry other charges, including a €9.99 issuance fee, a 2% foreign transaction fee for non-euro purchases, a €1.50 fee for euro withdrawals, a 2% fee for non-euro withdrawals, and a €10 annual maintenance fee.

Cost and Fees

KuCoin also provides customizable spending limits, offering users more flexibility in how they use their card. Additionally, there’s great news for Apple Pay and Google Pay users—KuCard supports both payment methods. However, it’s important to note that the card currently only supports USDT and EUR, with more currencies expected to be added in the future.

How to Get the KuCard

Step 1: Confirm that you’re a resident of an eligible country or region. Currently, the KuCard is available to residents of the EEA, but not to those in the UK. Since not all EEA countries are included, be sure to check the latest list of eligible countries on the KuCoin website.

Step 2: Create a KuCoin account and complete the KYC (Know Your Customer) process, which includes identity verification and proof of address—standard procedures when applying for a crypto debit card.

Before the card was officially launched, KuCoin ran a contest offering 1,000 USDT to anyone who registered for the KuCard. Initially, the card was free, but now a €9.99 issuance fee applies.

One of the standout features of the KuCoin debit card is its rewarding cashback program. By making purchases with the KuCard, users can earn cashback in a variety of cryptocurrencies, including BTC, ETH, USDT, KCS, and more, with cashback rewards of up to 4.7%. In addition to cashback, cardholders can also earn vouchers, gift cards, access to airport lounges, merchant discounts, and other exclusive perks.

If you’re hesitant about the KuCard due to its recent launch, there’s no need to worry. Although it’s new to the market, the KuCoin debit card has quickly gained recognition as one of the leading crypto debit cards, thanks to KuCoin’s solid reputation for quality service and reliability.

With KuCoin’s established track record, you can trust that the KuCard offers a seamless, user-friendly experience.

KuCoin is known for its strong emphasis on security, making it a trusted platform for users. The platform employs various security measures to protect users’ funds, including two-factor authentication, anti-phishing codes, and multi-layered security systems.

In addition to its security features, KuCoin offers an intuitive interface that’s easy to navigate, making it ideal for both beginners and experienced traders alike. The platform also provides excellent customer support, available 24/7 through multiple channels, including email, live chat, and social media.

Overall, the KuCoin debit card is an excellent choice for those looking for a dependable and convenient way to spend their crypto on everyday purchases. With its rewards program, ease of use, and robust security, it’s definitely worth considering!

The Crypto.com card is a custodial card designed for users who want to easily spend or convert their digital assets. In addition, it allows users to make the most of their cryptocurrency holdings by earning rewards through spending and staking.

Features

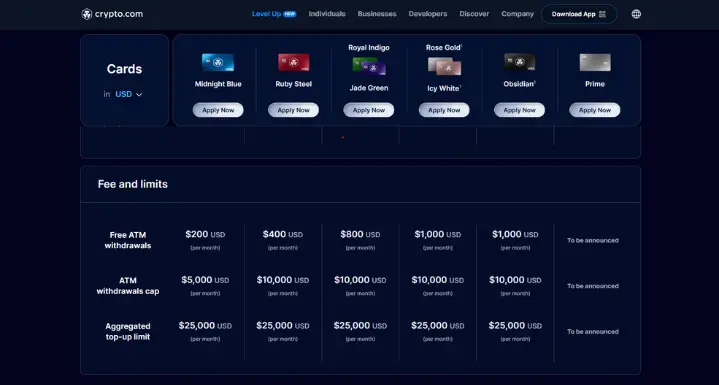

The Crypto.com card is a prepaid card available in multiple tiers, each offering unique benefits depending on the amount of CRO (Crypto.com’s native token) staked.

1. Midnight Blue: A basic, no-frills card for users seeking simplicity. No staking is required, and it provides fundamental benefits without rewards on spending.

2. Ruby Steel: Requires staking 5,000 CRO to earn 1% cashback on purchases. Users also get additional perks, including a 100% rebate on their Spotify subscription for the first six months.

3. Royal Indigo/Jade Green: Requires staking 50,000 CRO to earn 2% back on purchases. This tier also offers 100% rebates on Spotify and Netflix subscriptions for the first six months.

4. Icy White/Frosted Rose Gold: Requires staking 500,000 CRO to earn 3% cashback on purchases and unlock exclusive Crypto.com Private benefits. Additional perks include airport lounge access and 100% rebates on subscriptions like Spotify, Amazon Prime, and Netflix.

5. Obsidian: Requires a minimum staking of 5,000,000 CRO, unlocking the most exclusive Crypto.com Private benefits, such as higher rewards on Crypto Earn and private jet service perks. Users also receive 100% reimbursement for Spotify, Netflix, and Amazon Prime subscriptions, along with 12 months of X Premium subscriptions.

Each tier supports a variety of cryptocurrencies, including Bitcoin, Ethereum, and CRO, and the card can be used at any merchant globally where Visa is accepted.

Cost and Fees

The Crypto.com card has no annual or spending fees, but there are limits on free ATM withdrawals each month. The withdrawal limits vary by tier, ranging from $200 USD for the Midnight Blue card to $1,000 USD for the Obsidian card. Any withdrawals exceeding these limits, or those processed by ATM operators, may incur additional fees.

Users can load funds onto their card via bank transfers, other credit/debit cards, or cryptocurrency. When topping up with crypto, the funds are converted to fiat currency before being used for purchases or withdrawals. Depending on your location, there may be additional administrative fees for topping up via credit card. Please be aware that once funds are loaded onto your Crypto.com Visa card, they cannot be transferred back to your Fiat wallet.

Additionally, network transaction fees apply when transferring cryptocurrency off the platform, and a 0.1% processing fee is charged for transactions via the Lightning Network.

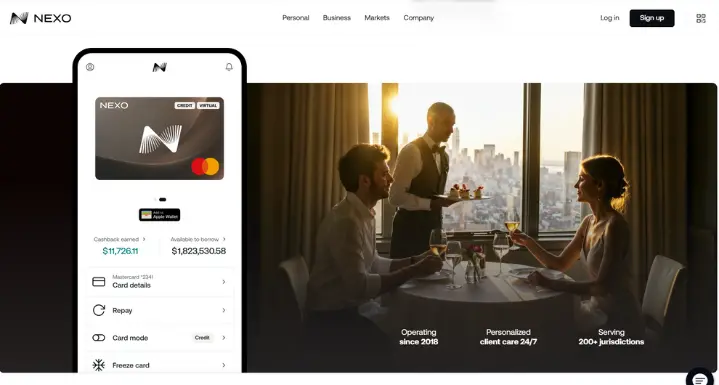

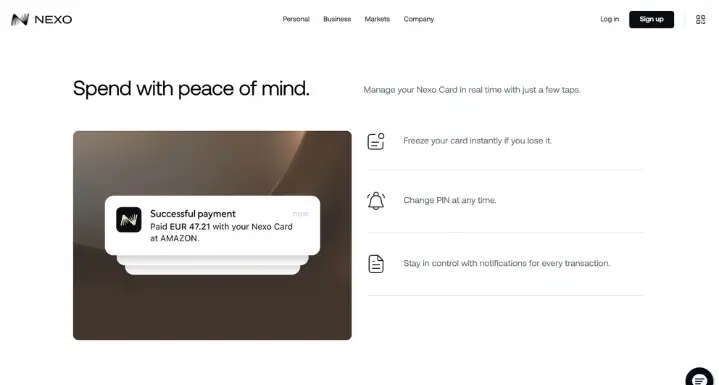

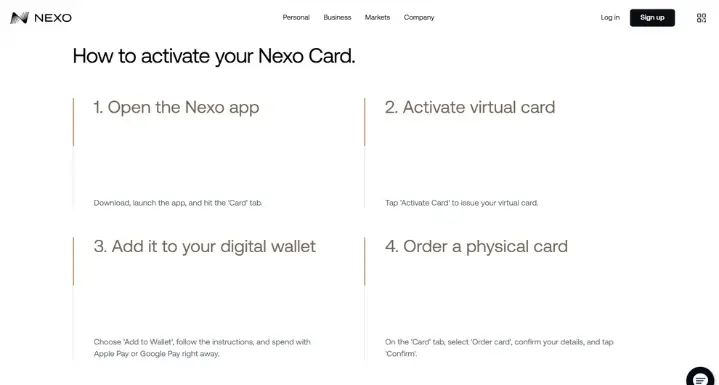

Another standout crypto card is from Nexo, a well-known cryptocurrency lending platform. The Nexo custodial card is especially popular among crypto users for its dual-mode functionality, offering both credit and debit options.

Features

The Nexo card is linked to users’ available balance on the Nexo platform and offers two modes of operation—(credit and debit)—which users can switch between at any time.

Credit Mode: In this mode, users can put up their crypto as collateral to make purchases without selling their assets. This allows users to retain the potential upside of their holdings while accessing funds at borrowing rates starting from 2.9%.

Debit Mode: Users can spend cryptocurrencies and stablecoins (EUR, GBP, USD) directly. In this mode, cardholders can earn up to 14% daily compound interest on their balance. Users also have the option to prioritize which assets to spend first for greater efficiency.

The Nexo card supports a variety of cryptocurrencies, including BTC, ETH, and stablecoins such as USDT.

It is currently (available to residents) of the European Economic Area (EEA) and the United Kingdom (UK).

Cost and Fees

Activating the virtual Nexo card is free with a minimum deposit of $50 into the Nexo account. Physical cards are (shipped free) of charge to users with a Portfolio-balance of at least ($500 and a Gold Loyalty) tier.

In credit mode, borrowing rates start at 2.9% and can go up to 18.9% per year, allowing users to access funds without selling their crypto. Debit mode has (no monthly), annual, or inactivity fees.

With the Nexo card, users can earn up to 2% cashback in NEXO tokens or 0.5% in BTC on purchases made using credit mode. In debit mode, users earn daily compound interest based on their loyalty tier, with rates reaching up to 14% in NEXO tokens or 12% in-kind. The card also allows up to 5 free ATM withdrawals per month, with daily and monthly withdrawal limits.

Next, let’s explore non-custodial crypto cards.

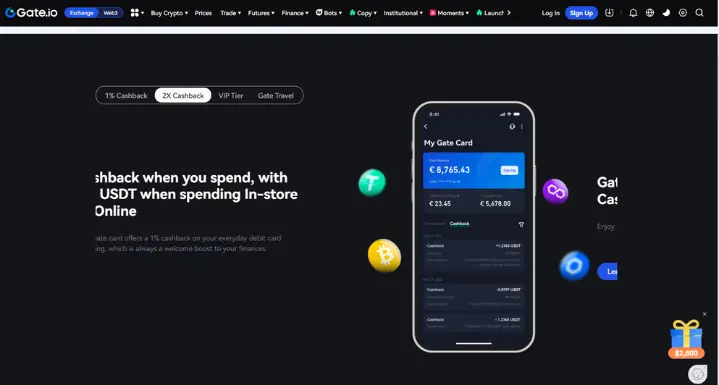

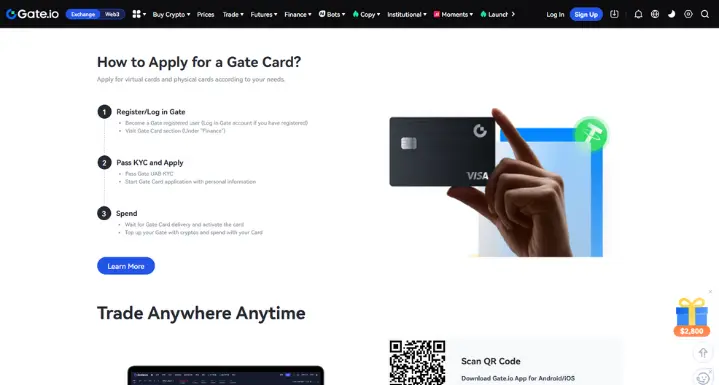

The Gate.io card is another solid option for those looking for a crypto debit card. Offered by the popular cryptocurrency exchange Gate.io, this card allows users to spend both crypto and fiat directly from their Gate.io account at millions of merchants worldwide.

Features

Type of Card: The Gate.io card is a debit card, not a credit card. It functions similarly to other crypto debit cards, allowing you to spend crypto or fiat funds at merchants that accept traditional debit cards.

Global Acceptance: The card is powered by Visa, which means it can be used anywhere Visa is accepted—over 60 million merchants globally.

Supported Cryptocurrencies: The card supports a range of popular cryptocurrencies, including BTC, ETH, USDT, and more. You can easily spend these assets directly from your Gate.io account, without needing to pre-convert them into fiat.

Fiat Currency Support: The card also supports fiat currencies like EUR, USD, and others, making it versatile for global usage.

Ease of Use: The Gate.io card is linked directly to your Gate.io exchange account, so there’s no need to connect to third-party wallets or accounts. This streamlined process makes it easier to access and spend your funds.

Cashback & Rewards: Some versions of the card offer cashback rewards or loyalty benefits for purchases made with crypto. Specific rewards and percentages can vary depending on your account status or card tier.

No Hidden Fees: The Gate.io card aims to be transparent with fees, with no annual fees and competitive transaction fees. However, users should always check for any country-specific charges or limits, such as ATM withdrawal fees.

Security: Like most crypto debit cards, the Gate.io card uses strong security measures to protect your funds, including two-factor authentication (2FA) and other encryption technologies.

Eligibility and Availability

1. The Gate.io card is available to users in selected countries, so you may need to check if your country is eligible for this card.

2. Typically, the card can be used for both online and in-person purchases, making it a flexible option for those who want to use crypto in everyday transactions.

Conclusion

1. Binance Card stands out for its generous cashback (up to 8% in BNB) and extensive crypto support, making it ideal for users already integrated into the Binance ecosystem.

2. The KuCoin Card is a solid choice for crypto enthusiasts who want flexibility between crypto and fiat, with strong loyalty rewards for KCS token holders.

3. The Coinbase Card is the most user-friendly option, perfect for beginners or those already using Coinbase for trading. It’s simple, widely accepted, but it does come with higher fees for crypto-to-fiat conversions.

4. The Bybit Card is an excellent choice for active traders looking for cashback, rewards, and low fees, especially those already using Bybit for trading, but it has more limited availability.

In the end, the best card for you depends on which exchange you use most frequently, the crypto assets you hold, your location, and whether you prioritize cashback rewards, low fees, or ease of use.

Our Top Recommended Crypto Cards

Subscribe to our Newsletter

Receive the latest updates on cryptocurrency news directly to your inbox.

(Your privacy is important to us.)

Top Three Most Popular Coupon Codes

FAQ

A cryptocurrency card allows you to spend your digital assets (like Bitcoin, Ethereum, or other cryptocurrencies) in real-time at merchants that accept traditional debit or credit cards. The card instantly converts your cryptocurrency into fiat currency when making a purchase.

Crypto.com Visa Card

The Crypto.com Visa Card offers up to 5% cashback, complimentary access to airport lounges, and discounts on services like Spotify and Netflix. It's available in multiple tiers based on the amount of CRO (Crypto.com’s native token) staked.

Binance Card

Binance offers a Visa card that lets you spend a variety of cryptocurrencies, including Bitcoin and Binance Coin (BNB), with up to 8% cashback. It's available in several regions and has no annual fee for users with certain holdings.

Coinbase Card

The Coinbase Card is linked to your Coinbase account, allowing you to spend supported cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Users earn rewards on purchases and can easily load the card via the app.

Nexo Card

The Nexo card allows you to spend your crypto and offers up to 2% cashback. It’s connected to your Nexo account, allowing you to withdraw crypto-backed loans.

BlockFi Rewards Visa Card

This card provides 1.5% cashback in Bitcoin on all purchases, with no annual fee. It's a great option for those looking to accumulate more Bitcoin.

You can apply for a crypto card directly through the issuing platform's app or website. After completing identity verification, you'll receive a physical or virtual card for use.

Yes, cryptocurrency cards are generally secure, with most offering advanced encryption, two-factor authentication (2FA), and other security features to protect your assets and transactions.

Fees vary depending on the card. Some charge annual fees, withdrawal fees, or foreign exchange fees, while others, like the Binance Card, have no annual fees. Always check the specific card’s terms for full details.