6 Best Crypto Staking Platforms in 2025

Last updated: 29/08/2025

Crypto staking platforms allow users to earn rewards by locking up cryptocurrencies, supporting network security and validating transactions.

4.9

Read our review

Fees

0.1%

Payment Options

Binance Pay / Crypto

Available Coins

BTC, BNB +500

Binance Crypto Staking Platform allows users to stake various cryptocurrencies, earning passive rewards through network validation. It supports multiple staking options with flexible terms, offering competitive yields. Binance ensures security and ease of use, making it a popular choice for both beginners and experienced crypto investors seeking reliable returns.

Crypto.com Crypto Staking Platform offers users the opportunity to stake a variety of cryptocurrencies, earning rewards in return. With flexible staking durations and attractive interest rates, it provides a seamless experience for users. The platform also integrates with other Crypto.com services, enhancing convenience for both beginners and advanced investors.

Bybit Crypto Staking Platform allows users to stake various cryptocurrencies and earn rewards through passive income. It offers competitive returns with flexible staking options and secure transactions. Bybit's platform is user-friendly, making it accessible for both new and experienced crypto investors seeking to grow their holdings efficiently.

4.8

Read our review

Fees

0.07% – 0.20%

Payment Options

Crypto/Card

Available Coins

NEXO, ETH +105

Nexo Crypto Staking Platform enables users to earn interest by staking a wide range of cryptocurrencies. Offering flexible terms and competitive rates, it provides a secure and easy-to-use interface. Nexo’s platform is designed for both beginners and experienced investors, delivering passive income while maintaining high liquidity and safety.

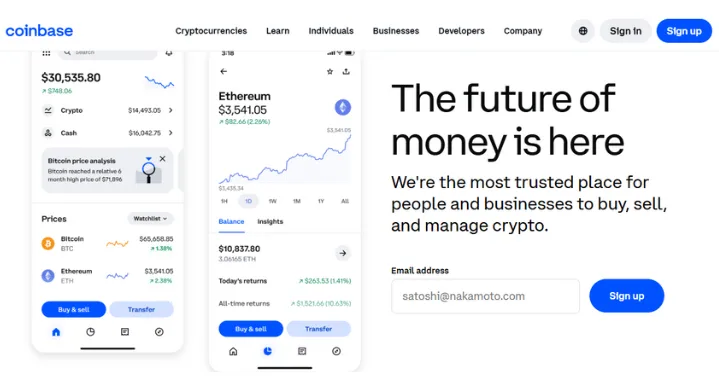

Coinbase Crypto Staking Platform allows users to earn rewards by staking select cryptocurrencies like Ethereum and Tezos. With a user-friendly interface, it simplifies the staking process for beginners. Coinbase handles staking on behalf of users, offering security and reliable returns, making it an accessible option for crypto investors.

KuCoin Crypto Staking Platform offers users the opportunity to stake a wide variety of cryptocurrencies, earning rewards based on staking duration and asset type. With flexible terms and competitive yields, KuCoin ensures secure and efficient staking, catering to both novice and experienced investors seeking passive income opportunities in the crypto market.

Disclosure: To maintain the operation of our site free of charge, we may occasionally earn a small commission if a reader chooses to purchase services through links on our site, at no extra cost to them. Read about disclosure here

Crypto staking platforms allow users to earn rewards by locking up their cryptocurrencies to support blockchain networks. In exchange for staking, users receive passive income, usually in the form of additional tokens. These platforms simplify the staking process, making it accessible even to beginners.

Most crypto staking platforms offer a variety of supported cryptocurrencies, flexible staking durations, and competitive rewards. They also ensure the security of user funds through advanced measures like cold storage and encryption. With these features, staking platforms provide an easy and efficient way for investors to earn returns on their digital assets.

What is a Crypto Staking Platform?

Crypto staking platforms allow users to participate in blockchain networks by locking up their cryptocurrencies. This process helps secure and validate transactions, and in return, users earn rewards, typically in the form of additional tokens. Staking is an efficient way for investors to generate passive income while supporting decentralized networks. These platforms simplify the staking process, making it accessible for both novice and experienced crypto users without the need for complex technical knowledge.

Key advantages of using crypto staking platforms include:

- Earn Passive Income: Staking rewards allow users to generate income just by holding their digital assets.

- Wide Range of Supported Cryptocurrencies: Platforms offer staking for various popular cryptocurrencies, giving users flexibility in choosing assets to stake.

- Enhanced Security: Reputable staking platforms employ advanced security protocols, such as cold storage, to protect user funds from theft or hacking.

- User-Friendly Interfaces: These platforms are designed with simplicity in mind, making it easy for beginners to stake their assets without needing extensive knowledge of blockchain technology.

Overall, crypto staking platforms present a user-friendly and secure way to earn passive income while contributing to the growth of blockchain ecosystems.

How Do Crypto Lending and Staking Differ?

Mechanism of Earning

Crypto lending involves lending your digital assets to borrowers through a lending platform. You earn interest over time, similar to traditional lending, while still retaining ownership of the assets. On the other hand, crypto staking involves locking up your assets in a blockchain network to help validate transactions, secure the network, and maintain its operations. In return, you earn rewards, usually in the form of additional tokens, for participating in the network’s consensus mechanism.

Risk Profile

Crypto lending carries higher risks compared to staking, as it depends on the borrower’s ability to repay the loan. If the borrower defaults, you could lose your funds. In contrast, staking typically carries lower risks since the assets are locked in the blockchain network and help support its security. However, staking is subject to network risks, such as potential bugs or vulnerabilities within the blockchain protocol, though these risks are generally lower.

Asset Control

In crypto lending, you retain ownership of the assets throughout the lending period. You only lend your crypto temporarily, and once the loan term ends, you get your principal back along with earned interest. In staking, however, your assets are locked within the network, and you cannot access or withdraw them until the staking period ends or conditions are met, which means you temporarily lose control over your assets.

Returns and Duration

Crypto lending platforms usually offer fixed or variable interest rates, with returns typically paid periodically. The duration of lending can vary depending on the platform and the terms agreed with the borrower. Staking rewards, on the other hand, are generally more variable and are based on factors like the amount of crypto staked and the network’s performance. Staking periods can also vary, with some platforms offering flexible staking options, while others may have lock-up periods to ensure longer-term network participation.

How to Select the Best Platform for Staking

Selecting the best platform for staking involves evaluating several key factors to ensure security, ease of use, and profitability. Here’s how to make an informed choice:

- Security and Reputation: Choose a platform with strong security measures like two-factor authentication, cold storage, and a solid reputation in the crypto community. Research user reviews and the platform’s track record for handling assets securely.

- Supported Cryptocurrencies: Make sure the platform supports the cryptocurrencies you intend to stake. Some platforms offer a wide variety of assets, while others may focus on a few popular coins. Choose one that aligns with your portfolio.

- Staking Rewards and Fees: Compare the staking rewards offered by different platforms, as well as any associated fees. Higher rewards may come with higher risks or fees, so balance potential returns with the platform’s overall cost-effectiveness.

- User Interface and Support: Look for a platform with an intuitive and user-friendly interface, especially if you’re new to staking. Additionally, check for responsive customer support in case you encounter any issues or need assistance.

Top Crypto Staking Platforms: Our Recommended Picks

Our top recommended crypto staking platforms include Binance, Crypto.com, Bybit, Nexo, Coinbase, and KuCoin. Each offers unique features like competitive rewards, flexibility, and user-friendly interfaces, making them great choices for both beginners and experienced users looking to stake various cryptocurrencies securely and efficiently.

1. Binance: Best overall crypto staking platform

2. Crypto.com: Safest platform for crypto staking

3. Bybit: Best for a variety of crypto earning products

4. Nexo: Best for higher APY for NEXO token holders

5. Coinbase: Top centralized staking platform for U.S. users

6. KuCoin: Best platform for staking altcoins

1. Binance: Best overall crypto staking platform

Binance Crypto Staking Platform offers a comprehensive and user-friendly solution for individuals looking to earn rewards through staking. As one of the world’s largest cryptocurrency exchanges, Binance provides a wide variety of staking options, including flexible and locked staking, making it suitable for both beginners and experienced users. The platform supports popular cryptocurrencies like Ethereum, Binance Coin (BNB), Polkadot, and Cardano, allowing users to participate in a broad range of proof-of-stake (PoS) networks. Binance’s staking service is designed to be secure, with top-notch infrastructure and advanced features, ensuring both ease of use and safety for stakers.

Key Features of Binance Crypto Staking

- Wide Range of Cryptos: Binance supports staking for numerous coins, including popular assets like Ethereum 2.0, Polkadot, and Binance Coin (BNB), offering flexibility for users to choose their preferred cryptocurrencies.

- Flexible & Locked Staking: Binance offers both flexible staking, where users can withdraw their staked assets anytime, and locked staking, where assets are locked for a specific period to earn higher rewards.

- High Rewards: Binance offers competitive annual percentage yields (APYs) for staking, with rewards that vary based on the crypto and staking duration.

- Staking Pools: Binance enables users to participate in staking pools, pooling their assets together to maximize rewards and share profits with other participants.

- User-Friendly Interface: Binance’s platform is intuitive, making it easy for new users to get started with staking while offering advanced features for experienced investors.

4.9

Read our review

Fees

0.1%

Payment Options

Binance Pay / Crypto

Available Coins

BTC, BNB+500

Binance Crypto Staking Platform allows users to stake various cryptocurrencies, earning passive rewards through network validation. It supports multiple staking options with flexible terms, offering competitive yields. Binance ensures security and ease of use, making it a popular choice for both beginners and experienced crypto investors seeking reliable returns.

2. Crypto.com: Safest platform for crypto staking

Crypto.com Crypto Staking Platform is a top choice for users seeking a secure and rewarding staking experience. Known for its extensive range of services, Crypto.com allows users to stake a variety of cryptocurrencies and earn rewards with minimal effort. The platform offers both flexible and fixed-term staking options, with varying rewards depending on the cryptocurrency and duration. Additionally, Crypto.com ensures high levels of security, making it a safe option for users looking to stake their assets. With its easy-to-use app and competitive interest rates, Crypto.com stands out as one of the safest platforms for staking crypto, particularly for those looking to earn rewards in stablecoins or native tokens like CRO (Crypto.com’s native token).

Key Features of Crypto.com Crypto Staking

- Wide Crypto Selection: Crypto.com supports a broad range of cryptocurrencies for staking, including Bitcoin, Ethereum, and its native CRO token, offering flexibility for users.

- Flexible & Fixed Staking: Users can choose between flexible staking, which allows for easy withdrawals, and fixed-term staking, which offers higher rewards for longer commitments.

- Security: Crypto.com provides high security with two-factor authentication (2FA) and other industry-leading protections, ensuring staked assets are safe from theft or hacking.

- Rewards in CRO & Stablecoins: Stakers can earn rewards in Crypto.com’s native CRO token or stablecoins like USDT, which offer stability alongside returns.

- Mobile App Convenience: The platform’s mobile app provides a user-friendly experience, allowing users to stake, track rewards, and manage their assets on the go.

Crypto.com Crypto Staking Platform offers users the opportunity to stake a variety of cryptocurrencies, earning rewards in return. With flexible staking durations and attractive interest rates, it provides a seamless experience for users. The platform also integrates with other Crypto.com services, enhancing convenience for both beginners and advanced investors.

3. Bybit: Best for a variety of crypto earning products

Bybit Crypto Staking Platform provides a versatile staking experience, catering to both new and seasoned cryptocurrency investors. Bybit offers a variety of staking products that allow users to earn rewards with minimal effort. Known for its fast transaction speeds and secure infrastructure, Bybit supports a range of popular cryptocurrencies, including Ethereum 2.0, Polkadot, and Solana. With competitive annual percentage yields (APYs) and a simple user interface, Bybit makes it easy for anyone to participate in staking. The platform’s added features, like flexible staking options and staking pools, further enhance its appeal, making it an attractive option for those looking to earn passive income from their digital assets.

Key Features of Bybit Crypto Staking

- Variety of Cryptos: Bybit supports a broad selection of assets for staking, including popular options like Ethereum 2.0, Solana, and Polkadot, providing users with a variety of investment choices.

- Flexible Staking Options: Bybit offers flexible staking, enabling users to stake assets for varying periods and easily withdraw their funds when needed, offering liquidity and convenience.

- Competitive Rewards: The platform provides attractive APYs, with higher returns for staking certain cryptocurrencies and longer durations, making it an appealing choice for reward seekers.

- Staking Pools: Bybit allows users to participate in staking pools, where assets are pooled together, maximizing returns and reducing the risks associated with individual staking.

- User-Friendly Interface: Bybit’s platform is designed for simplicity, offering both novice and experienced users a smooth staking experience through its clean, easy-to-navigate interface.

Bybit Crypto Staking Platform allows users to stake various cryptocurrencies and earn rewards through passive income. It offers competitive returns with flexible staking options and secure transactions. Bybit's platform is user-friendly, making it accessible for both new and experienced crypto investors seeking to grow their holdings efficiently.

4. Nexo: Best for higher APY for NEXO token holders

Nexo Crypto Staking Platform offers an efficient and rewarding way to earn passive income from cryptocurrency holdings. Known for its high-yield opportunities, Nexo enables users to stake a wide range of cryptocurrencies, including Bitcoin, Ethereum, and NEXO tokens, through both flexible and fixed-term staking options. Nexo’s platform stands out for its unique benefit of offering higher annual percentage yields (APYs) to NEXO token holders, making it an attractive option for those looking to maximize their staking rewards. Additionally, the platform’s security features, including industry-leading custodial insurance and two-factor authentication, provide users with peace of mind. With no hidden fees and the ability to earn rewards in either crypto or stablecoins, Nexo makes staking accessible and profitable.

Key Features of Nexo Crypto Staking

- Higher APY for NEXO Holders: Nexo offers higher staking rewards for users who hold its native NEXO token, allowing them to earn better returns compared to non-holders.

- Wide Crypto Selection: Nexo supports a variety of cryptocurrencies for staking, including major coins like Bitcoin, Ethereum, and stablecoins like USDT, offering flexibility in investment choices.

- Flexible & Fixed-Term Staking: Users can choose between flexible staking, which allows for withdrawals at any time, or fixed-term staking, which offers higher rewards for longer commitments.

- Security Features: Nexo provides robust security, including custodial insurance and two-factor authentication (2FA), ensuring the safety of staked assets.

- No Fees: Nexo boasts a transparent fee structure with no hidden fees, allowing users to stake their assets and keep the full rewards generated.

4.8

Read our review

Fees

0.01% – 0.20%

Payment Options

Crypto/Card

Available Coins

BTC, NEXO +105

Nexo Crypto Staking Platform enables users to earn interest by staking a wide range of cryptocurrencies. Offering flexible terms and competitive rates, it provides a secure and easy-to-use interface. Nexo’s platform is designed for both beginners and experienced investors, delivering passive income while maintaining high liquidity and safety.

5. Coinbase: Top centralized staking platform for U.S. users

Coinbase Crypto Staking Platform is a leading choice for users in the United States, offering a straightforward and secure way to earn rewards from staking. Known for its ease of use, Coinbase allows users to stake a range of cryptocurrencies such as Ethereum, Tezos, and Cosmos directly through its platform. The service is beginner-friendly, with no technical setup required, making it ideal for those new to crypto staking. While the rewards are competitive, they can vary depending on the cryptocurrency being staked and the network’s performance. Coinbase also offers transparency in its fee structure, ensuring users know exactly what they are paying. The platform’s high security and regulatory compliance further enhance its reputation, making it a trusted option for staking.

Key Features of Coinbase Crypto Staking

- User-Friendly Interface: Coinbase offers an easy-to-navigate platform, making it ideal for beginners who want to start staking without the complexity of more advanced platforms.

- Wide Range of Cryptos: Coinbase supports staking for popular cryptocurrencies like Ethereum, Tezos, and Cosmos, providing a variety of staking options.

- No Minimum Staking Requirements: Users can stake as little or as much as they like, making it accessible for those with different investment sizes.

- Secure and Regulated: Coinbase is a regulated platform that prioritizes security, offering insurance for assets stored on the platform and robust security measures like two-factor authentication (2FA).

- Transparent Fees: Coinbase clearly outlines its staking fees, which are deducted directly from rewards, ensuring users know exactly what they are paying for staking services.

Coinbase Crypto Staking Platform allows users to earn rewards by staking select cryptocurrencies like Ethereum and Tezos. With a user-friendly interface, it simplifies the staking process for beginners. Coinbase handles staking on behalf of users, offering security and reliable returns, making it an accessible option for crypto investors.

6. KuCoin: Best platform for staking altcoins

KuCoin Crypto Staking Platform is a popular choice for users looking to stake a wide variety of cryptocurrencies and earn passive income. The platform offers a range of flexible and fixed-term staking options, allowing users to choose based on their preferred staking duration and potential returns. KuCoin supports many altcoins, making it an excellent platform for users interested in staking lesser-known cryptocurrencies alongside major assets like Ethereum and Bitcoin. The platform’s rewards are competitive, and users can earn staking rewards both in the form of crypto or tokens native to the staked coins. KuCoin’s user-friendly interface and comprehensive staking features make it an appealing option for both beginners and experienced investors.

Key Features of KuCoin Crypto Staking

- Wide Range of Altcoins: KuCoin offers staking for a variety of altcoins beyond just popular cryptocurrencies like Bitcoin and Ethereum, giving users access to diverse staking opportunities.

- Flexible and Fixed-Term Staking: Users can choose between flexible staking, which allows for easy withdrawal of assets, and fixed-term staking, offering higher rewards for longer lock-up periods.

- Competitive Rewards: KuCoin provides attractive staking rewards with competitive annual percentage yields (APYs), which vary depending on the asset and staking duration.

- Staking Pools: KuCoin allows users to participate in staking pools, combining their assets with others to maximize rewards and reduce risks associated with individual staking.

- User-Friendly Interface: KuCoin’s platform is intuitive, offering an easy experience for new users to start staking while providing advanced features for more experienced investors.

KuCoin Crypto Staking Platform offers users the opportunity to stake a wide variety of cryptocurrencies, earning rewards based on staking duration and asset type. With flexible terms and competitive yields, KuCoin ensures secure and efficient staking, catering to both novice and experienced investors seeking passive income opportunities in the crypto market.

Types of Crypto Staking Platforms

Crypto staking platforms allow users to participate in proof-of-stake (PoS) networks by locking up their cryptocurrency to support blockchain operations and earn rewards. There are several types of staking platforms, each with its unique features:

Centralized Staking Platforms

These platforms are run by centralized entities such as exchanges. They offer ease of use, with minimal technical knowledge required. Popular platforms like Binance, Coinbase, and Kraken provide users the ability to stake a variety of cryptocurrencies and earn rewards. However, these platforms come with counterparty risk as users trust the platform to manage their assets securely.

Decentralized Staking Platforms

These platforms are typically built on decentralized protocols, enabling users to stake directly from their wallets. Examples include platforms like Lido and Rocket Pool. Decentralized staking is more secure since users retain control of their private keys, but it may require more technical knowledge to set up and use.

Staking-as-a-Service:

These are specialized third-party providers offering staking services. They manage the staking process on behalf of users, typically for a fee. Providers like Figment or Staked cater to institutional investors and individuals who prefer a hands-off staking experience.

Wallet-Based Staking

Some cryptocurrency wallets, such as Exodus and Trust Wallet, allow users to stake directly from the wallet. This provides a balance of security and convenience, as users maintain control of their assets while participating in staking.

Governance Staking Platforms

These platforms allow users to stake tokens to participate in the governance of a blockchain. Users who stake tokens can vote on network upgrades and changes, adding a layer of decision-making power in addition to earning staking rewards.

Risks and Challenges of Crypto Staking

Crypto staking offers opportunities for passive income, but it also comes with several risks and challenges:

- Market Volatility: The value of staked assets can fluctuate dramatically. If the price of the staked cryptocurrency decreases significantly, it may offset the staking rewards, leading to potential losses.

- Slashing Risks: In some proof-of-stake (PoS) systems, validators may face “slashing” penalties if they behave maliciously or fail to perform their duties properly. This can lead to the loss of a portion of the staked tokens, affecting the overall return for users.

- Lock-Up Periods: Many staking platforms require users to lock their tokens for a certain period. During this time, users cannot access or sell their assets, which can be risky if market conditions change suddenly.

- Centralization Risk: Staking through centralized exchanges or platforms exposes users to the risk of platform failure, hacking, or regulatory issues. If the platform is compromised, users may lose their staked tokens or rewards.

- Technical Complexity: Staking on decentralized platforms or directly from wallets often requires a certain level of technical knowledge. Incorrect configurations or mistakes can result in loss of funds or missed rewards.

- Network Risk: The blockchain network itself could face technical issues, such as bugs, downtime, or vulnerabilities. These can impact the ability to earn rewards or even result in a loss of staked tokens.

- Reward Uncertainty: Staking rewards are not guaranteed and can fluctuate depending on network conditions, validator performance, and the number of participants. This unpredictability can affect the overall profitability of staking.

Conclusion

In conclusion, crypto staking platforms offer an appealing opportunity for users to earn rewards by participating in blockchain networks that utilize proof-of-stake (PoS) consensus mechanisms. With various options available, such as centralized exchanges, decentralized protocols, staking-as-a-service providers, and wallet-based solutions, users can select a platform based on their preferences, technical knowledge, and desired level of control.

However, staking is not without its risks. Factors like market volatility, slashing penalties, lock-up periods, and centralized platform risks can affect the profitability and security of staked assets. Additionally, the complexity of staking on decentralized platforms and the unpredictability of staking rewards add further challenges for users. It’s important to carefully evaluate these risks before getting involved.

To ensure a positive staking experience, users should conduct thorough research, choose trustworthy platforms, and stay informed about the specific terms and conditions associated with staking. By understanding both the potential rewards and inherent risks, participants can make informed decisions and enjoy the benefits of staking while minimizing potential pitfalls. Crypto staking can be a lucrative and rewarding activity when approached with caution and knowledge.

Our Top Recommended NFT Marketplace

Subscribe to our Newsletter

Receive the latest updates on cryptocurrency news directly to your inbox.

(Your privacy is important to us.)

Frequently Asked Questions (FAQs)

Crypto staking is the process of locking up your cryptocurrency in a proof-of-stake (PoS) blockchain network to support its operations, such as validating transactions, and earning rewards in return.

Staking platforms allow users to delegate their tokens to validators or nodes on a PoS network. The platform manages the staking process, and users earn rewards based on the amount staked, the validator's performance, and network conditions.

There are four main types: centralized exchanges (e.g., Binance, Coinbase), decentralized platforms (e.g., Lido, Rocket Pool), staking-as-a-service providers (e.g., Figment), and wallet-based platforms (e.g., Exodus, Trust Wallet).

Risks include market volatility, slashing penalties (for validator misconduct), lock-up periods that prevent asset access, centralization risks with exchanges, and network vulnerabilities. Rewards can also fluctuate based on network conditions

Withdrawal availability depends on the platform and network. Centralized exchanges often offer more flexibility, while decentralized platforms may require tokens to be locked for a set period, impacting liquidity.

Consider factors like ease of use, security, rewards offered, lock-up periods, fees, and the reputation of the platform. Always do thorough research to ensure the platform is reliable and secure.