Best Crypto Trading Bots for 2025: Automate Your Investment

Last updated: 30/08/2025

Explore the best crypto trading bots of 2025 to automate your investment strategy, boosting efficiency and maximizing returns effortlessly.

Pionex trading bots provide automated solutions for crypto traders, offering tools like grid trading and arbitrage. These bots simplify trading, enhance profit potential, and reduce manual effort, making them ideal for both novice and experienced investors.

Phemex trading bots offer automated solutions for crypto traders, featuring advanced strategies like spot and futures trading. Designed for efficiency and precision, these bots help users optimize trades, maximize profits, and minimize manual effort, suitable for all experience levels.

Bitget trading bots provide automated crypto trading solutions, offering strategies like grid and futures trading. These bots help users optimize market opportunities, boost trading efficiency, and minimize manual effort, making them suitable for both novice and experienced traders.

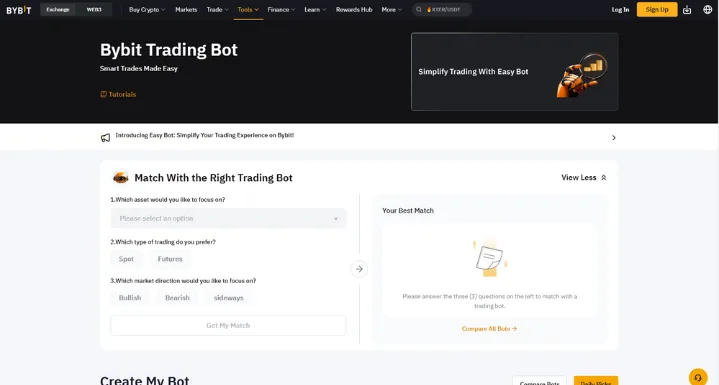

Bybit trading bots offer automated crypto trading with advanced strategies, including spot and futures trading. These bots enhance trading efficiency, optimize profits, and reduce manual intervention, making them ideal for both beginners and seasoned traders seeking smarter investment solutions.

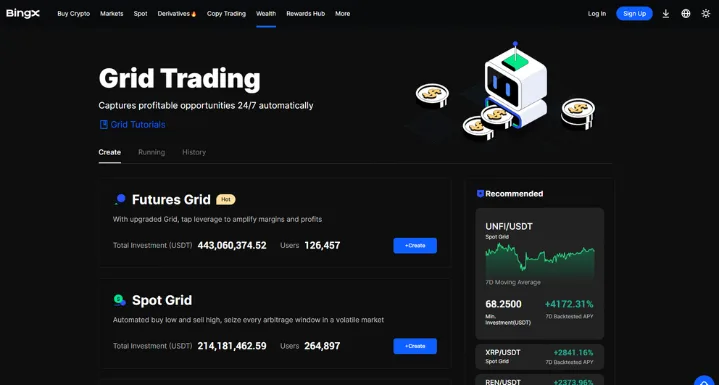

BingX trading bots provide automated crypto trading with tools like grid and copy trading. These bots help optimize strategies, increase trading efficiency, and maximize profits, offering a user-friendly experience suitable for both beginners and experienced traders.

Disclosure: To maintain the operation of our site free of charge, we may occasionally earn a small commission if a reader chooses to purchase services through links on our site, at no extra cost to them. Read about disclosure here

Crypto trading bots are automated software tools designed to execute trades in cryptocurrency markets based on predefined strategies. These bots analyze market data, identify trends, and place buy or sell orders without human intervention. By using algorithms, they can execute trades faster and more efficiently than manual trading, allowing users to capitalize on market opportunities 24/7.

There are various types of crypto bots, including arbitrage bots, market-making bots, and trend-following bots. Each bot is programmed to follow specific strategies to profit from price fluctuations or inefficiencies in the market. Traders can adjust parameters like risk levels, trading pairs, and timeframes to optimize performance.

While crypto trading bots offer advantages such as speed, consistency, and the ability to work around the clock, they are not without risks. Market volatility and unforeseen conditions can lead to losses, and improper configuration can result in missed opportunities or wrong trades. Traders should approach bots with caution and always monitor their performance.

What is a Crypto Trading Bot?

A crypto trading bot is an automated software designed to execute cryptocurrency trades on behalf of users. It analyzes market data, identifies trends, and places buy or sell orders based on predefined strategies. These bots operate 24/7, allowing traders to take advantage of market opportunities without constant monitoring.

Crypto bots can be customized to follow specific strategies like arbitrage or trend-following, helping users to make quicker, more efficient decisions while minimizing emotional trading risks.

Pros of Crypto Trading Bots

- 24/7 Trading: Crypto bots can operate around the clock, allowing traders to take advantage of market opportunities, even when they’re not available to monitor the markets.

- Speed and Efficiency: Bots execute trades faster than humans, enabling them to react to market changes in real-time and capitalize on small price fluctuations.

- Emotion-Free Trading: Bots follow predefined strategies, eliminating emotional decision-making that can lead to impulsive or irrational trades.

- Consistency: Crypto bots can maintain consistent trading strategies, reducing human error and improving long-term performance.

- Customizable: Traders can adjust bots to fit specific risk profiles, trading pairs, and strategies, offering flexibility and control over their trading approach.

Cons of Crypto Trading Bots

- Technical Issues: Bots depend on stable internet connections and functional software. Any technical malfunction or connectivity issues can lead to missed opportunities or losses.

- Over-Reliance on Algorithms: Bots follow predefined algorithms that may not adapt well to unexpected market shifts or external factors, increasing the risk of losses.

- Risk of Misconfiguration: Incorrect settings or strategies can result in poor trades or even financial loss if not monitored and adjusted regularly.

- Market Volatility: Bots may struggle in highly volatile markets where rapid changes can lead to unexpected losses.

Top Picks: Best AI Crypto Trading Bots

After reviewing and testing over 30 cryptocurrency trading bots based on factors like bot types, pricing, security, user interface, and more, we’ve compiled a list of the 9 best crypto trading bots.

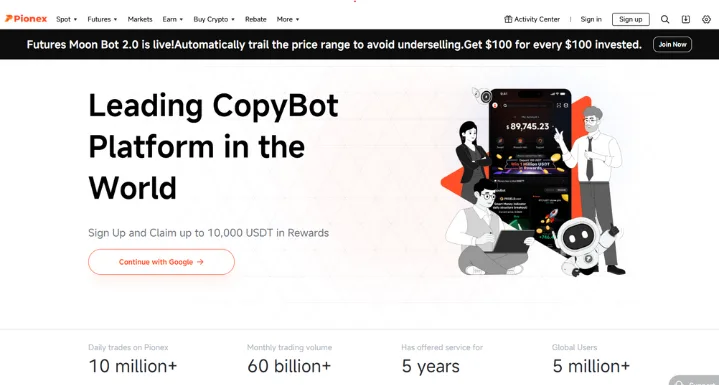

1. PioneX Trading Bots

PioneX Trading Bots offer an innovative and efficient way for users to engage in cryptocurrency trading with minimal manual effort. These automated bots use advanced algorithms to execute trades based on market trends and user-defined strategies, ensuring that trading continues even when the user is not actively monitoring the market. Whether you’re a novice or an experienced trader, PioneX makes it easy to maximize profits while minimizing risks, all while saving time. The platform supports a wide range of popular cryptocurrencies, making it versatile for users with different preferences. With features like backtesting, risk management tools, and customizable settings, PioneX allows users to tailor their trading experience for optimal results.

4 Key Features of PioneX Trading Bots

- Automated Trading: The bots execute trades based on pre-set strategies, allowing continuous trading without constant oversight.

- Customizable Strategies: Users can personalize trading strategies by adjusting settings like risk tolerance, trade size, and more.

- Backtesting: PioneX offers the ability to test strategies on historical data, enabling users to refine their approach before going live.

- Risk Management: The platform provides tools such as stop-loss and take-profit features, which help protect investments by limiting potential losses and locking in profits.

These features make PioneX an excellent choice for anyone looking to optimize their cryptocurrency trading experience.

Pionex trading bots provide automated solutions for crypto traders, offering tools like grid trading and arbitrage. These bots simplify trading, enhance profit potential, and reduce manual effort, making them ideal for both novice and experienced investors.

2. PhemeX Trading Bots

PhemeX Trading Bots offer a powerful solution for cryptocurrency traders seeking to automate their strategies and enhance trading efficiency. These bots utilize cutting-edge algorithms to analyze market trends and execute trades 24/7, ensuring users can take advantage of opportunities even when they’re not actively monitoring the market. By offering customizable strategies, risk management tools, and a user-friendly interface, PhemeX allows both beginners and experienced traders to fine-tune their trading approach for optimal results. With support for multiple cryptocurrencies, the platform offers flexibility to diversify portfolios and explore different markets. PhemeX’s advanced features, such as backtesting and performance analytics, enable users to optimize their strategies and make informed decisions.

4 Key Features of PhemeX Trading Bots

- Automated Trading: Bots carry out trades based on pre-set rules, allowing round-the-clock trading without manual intervention.

- Customizable Strategies: Users can adjust risk levels, trade size, and other settings to tailor their trading strategies to personal preferences.

- Backtesting: PhemeX offers a backtesting feature, allowing users to evaluate their strategies on historical market data to assess performance before live trading.

- Advanced Risk Management: The platform includes stop-loss, take-profit, and other risk mitigation tools to help safeguard investments and maximize profit potential.

With these robust features, PhemeX Trading Bots provide a comprehensive toolset for both novice and seasoned traders looking to optimize their cryptocurrency trading experience.

Phemex trading bots offer automated solutions for crypto traders, featuring advanced strategies like spot and futures trading. Designed for efficiency and precision, these bots help users optimize trades, maximize profits, and minimize manual effort, suitable for all experience levels.

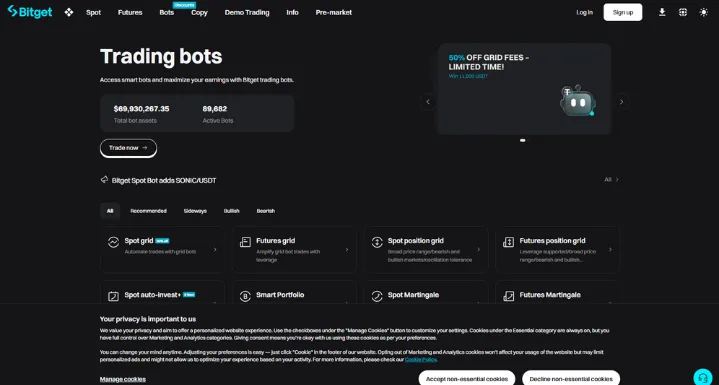

3. Bitget Trading Bots

Bitget Trading Bots offer an intuitive and efficient way to automate cryptocurrency trading strategies. By leveraging advanced algorithms, these bots can execute trades 24/7 based on market conditions, helping users capitalize on opportunities without being glued to the screen. Whether you’re a beginner or a professional, Bitget provides a user-friendly interface that makes setting up and managing trades seamless. The platform supports various cryptocurrencies and offers features like risk management tools, strategy customization, and backtesting to ensure that users can fine-tune their trading approach. With its automated nature and intelligent trading logic, Bitget’s bots reduce human error and maximize trading potential, giving users more time to focus on other priorities.

4 Key Features of Bitget Trading Bots

- Automated 24/7 Trading: Bitget bots execute trades continuously based on user-set strategies, eliminating the need for constant monitoring.

- Customizable Strategies: Users can personalize their trading strategies by adjusting parameters such as risk tolerance, trade size, and preferred assets.

- Backtesting: The platform allows users to test strategies on historical data, helping optimize performance before live trading.

- Risk Management Tools: Bitget provides advanced risk management features, including stop-loss and take-profit options, to help protect capital and secure profits.

These features make Bitget Trading Bots an attractive option for traders looking to optimize their cryptocurrency trading experience with greater precision and efficiency.

Bitget trading bots provide automated crypto trading solutions, offering strategies like grid and futures trading. These bots help users optimize market opportunities, boost trading efficiency, and minimize manual effort, making them suitable for both novice and experienced traders.

4. Bybit Trading Bots

Bybit Trading Bots provide a highly efficient and automated solution for cryptocurrency traders who want to optimize their trading strategies without constantly monitoring the markets. Using advanced algorithms, these bots execute trades 24/7, based on pre-set parameters and market conditions, allowing users to take advantage of price fluctuations even when they’re not online. Bybit’s platform is designed to be user-friendly, offering both beginners and experienced traders the ability to automate and customize their trading strategies with ease. Key features like backtesting, risk management tools, and strategy optimization ensure that users can refine their trading plans for maximum profitability. With support for a wide range of cryptocurrencies, Bybit Trading Bots enable users to diversify their portfolios and explore various trading opportunities across the crypto market.

4 Key Features of Bybit Trading Bots

- Automated Trading: The bots operate 24/7, executing trades based on user-defined strategies, allowing for continuous market participation without manual effort.

- Customizable Strategies: Bybit allows users to adjust parameters such as risk tolerance, trading size, and asset preferences to tailor their trading approach.

- Backtesting: Users can test their strategies using historical market data to ensure they are optimized before engaging in live trading.

- Risk Management Tools: Bybit offers robust features like stop-loss and take-profit to help minimize risks and lock in profits, ensuring more secure trading.

These features make Bybit Trading Bots an excellent tool for traders looking to enhance their cryptocurrency trading experience.

Bybit trading bots offer automated crypto trading with advanced strategies, including spot and futures trading. These bots enhance trading efficiency, optimize profits, and reduce manual intervention, making them ideal for both beginners and seasoned traders seeking smarter investment solutions.

5. BingX Trading Bots

BingX Trading Bots provide a smart and efficient way to automate cryptocurrency trading, making it easier for both novice and experienced traders to optimize their strategies. The bots are powered by advanced algorithms that monitor market trends and execute trades based on pre-defined parameters, offering users the ability to trade 24/7 without the need for constant attention. BingX’s user-friendly platform allows traders to set their risk preferences, choose from a variety of cryptocurrencies, and adjust their strategies as needed. With features like backtesting, real-time analytics, and automated risk management, BingX ensures that users can refine their trading approaches for maximum efficiency and profitability. These bots help users take advantage of market volatility while reducing human error, offering a seamless way to trade smarter and more effectively.

4 Key Features of BingX Trading Bots

- Automated 24/7 Trading: BingX bots execute trades around the clock, allowing users to capitalize on market opportunities even when they’re offline.

- Customizable Trading Strategies: Traders can personalize their strategies by adjusting risk tolerance, trade volume, and other key parameters to align with their goals.

- Backtesting Capabilities: Users can test their strategies on historical data, ensuring they are fine-tuned and optimized before real-time trading.

- Advanced Risk Management: BingX offers tools like stop-loss and take-profit to help users manage risks and secure profits while reducing exposure to potential losses.

These features make BingX Trading Bots a valuable tool for anyone looking to enhance their cryptocurrency trading experience.

BingX trading bots provide automated crypto trading with tools like grid and copy trading. These bots help optimize strategies, increase trading efficiency, and maximize profits, offering a user-friendly experience suitable for both beginners and experienced traders.

How to Select the Best Crypto Trading Bot?

Identify Your Trading Strategy

Choose a bot that aligns with your trading preferences, such as arbitrage, market-making, or trend-following. Different bots are designed for specific strategies, so selecting one that suits your approach will enhance your trading performance.

Pricing Structure

Crypto trading bots come with different pricing models. Some charge monthly subscriptions, while others may take a percentage of profits. Compare the costs of different bots and consider whether their features justify the price.

Security Features

Security is critical when selecting a trading bot. Ensure the bot uses advanced encryption and implements two-factor authentication (2FA) to safeguard your funds and personal information. Also, check if the bot is compatible with reputable exchanges known for their security standards.

Ease of Use

Choose a bot with a user-friendly interface that fits your skill level. A simple and intuitive dashboard is essential, especially if you’re new to trading. Look for bots that offer clear instructions and easy configuration for customizing settings.

Reputation and Reviews

Research the bot’s reputation by reading user reviews and performance reports. Bots with a solid track record of reliability and consistent profits are ideal. Additionally, verify the availability of responsive customer support in case issues arise.

Types of Crypto Trading Bots

There are several types of crypto trading bots, each designed to cater to different trading strategies and needs. Here are the most common types:

Arbitrage Bots

These bots take advantage of price discrepancies between different exchanges. When a cryptocurrency is priced differently on two platforms, the bot buys on the cheaper exchange and sells on the more expensive one, profiting from the difference.

Market-Making Bots

Market-making bots create buy and sell orders for a specific cryptocurrency, providing liquidity to the market. They profit by earning small price differences between buy and sell orders. These bots are ideal for traders who want to profit from market fluctuations and spread.

Trend-Following Bots

These bots use technical analysis to identify and follow market trends. They buy when the market shows an uptrend and sell when a downtrend is detected, aiming to profit from sustained price movements.

Scalping Bots

Scalping bots focus on making small profits from tiny price changes over short time frames. They execute many trades throughout the day, taking advantage of small fluctuations in price to accumulate profits quickly.

Portfolio Rebalancing Bots

These bots automatically adjust the distribution of assets in a trader’s portfolio. They buy and sell different cryptocurrencies to maintain a predefined allocation, ensuring a balanced portfolio in line with the user’s risk tolerance.

Conclusion

Crypto trading bots can be powerful tools for automating cryptocurrency trading, offering advantages such as 24/7 market access, faster execution, and reduced emotional trading. By using algorithms, these bots can help traders make more efficient decisions and execute strategies without constant manual intervention. However, it’s crucial to choose the right bot based on factors like security, pricing, and strategy alignment.

Despite their benefits, trading bots come with risks, including technical issues, market volatility, and the possibility of misconfiguration. Therefore, it’s essential to continuously monitor bot performance and adjust settings as needed. By carefully selecting and managing your crypto trading bot, you can optimize your trading experience and potentially enhance profitability in the fast-paced world of cryptocurrency.

Our Top Recommended NFT Marketplace

Subscribe to our Newsletter

Receive the latest updates on cryptocurrency news directly to your inbox.

(Your privacy is important to us.)

Frequently Asked Questions (FAQs)

A crypto trading bot is an automated software that executes trades on behalf of a user based on predefined strategies. It analyzes market data, identifies trends, and places buy or sell orders, allowing traders to capitalize on market opportunities without being online all the time.

Crypto bots use algorithms and technical analysis to monitor the market. They execute trades according to set parameters like price targets, risk tolerance, and market trends. These bots can work 24/7 and adapt to changing market conditions without human intervention.

While crypto trading bots can enhance profitability, they are not guaranteed to generate profits. Success depends on the bot’s strategy, market conditions, and settings. It’s important to monitor and adjust bots regularly to optimize performance.

Most crypto trading bots come with user-friendly interfaces and pre-configured strategies, making them accessible to beginners. However, some advanced bots may require a basic understanding of coding for customization and fine-tuning strategies.

Crypto bots can be safe if they follow proper security protocols, such as encryption and two-factor authentication (2FA). It's crucial to choose bots from reputable developers and ensure they are compatible with secure exchanges. Always monitor your bot's performance and security settings to mitigate risks.