Best Crypto Leverage Trading Platforms in 2025

Last updated: 09/09/2025

Crypto leverage trading platforms allow traders to borrow funds to amplify positions, increasing potential profits and risks in cryptocurrency markets.

4.9

Read our review

Fees

0.1%

Payment Options

Binance Pay / Crypto

Available Coins

BTC, BNB +500

Binance leverage trading allows users to borrow funds to trade larger positions than their account balance, amplifying potential profits and risks. It offers leverage from 2x to 125x, enabling traders to maximize returns in volatile markets, but also increasing the possibility of significant losses. Caution is advised.

Coinbase leverage trading enables users to trade with borrowed funds, amplifying potential profits or losses. Offering up to 3x leverage on selected assets, it allows traders to increase exposure in the market. However, higher risk comes with increased leverage, requiring careful risk management and understanding of market fluctuations.

Bybit leverage trading allows users to borrow funds to trade larger positions, with leverage up to 100x on cryptocurrencies. This amplifies potential gains but also increases risk. The platform offers advanced tools like stop-loss and take-profit orders to manage risk, making it essential for users to trade cautiously.

MEXC leverage trading lets users borrow funds to trade with higher positions, offering up to 125x leverage on selected cryptocurrencies. This enhances profit potential but also increases risk. The platform provides tools like stop-loss and margin calls to help manage risk, requiring users to trade responsibly.

BingX leverage trading allows users to trade with borrowed funds, offering leverage up to 50x on crypto pairs. This amplifies both profits and risks. The platform features risk management tools like stop-loss and take-profit orders, encouraging users to trade cautiously and manage potential losses effectively.

OKX leverage trading enables users to amplify positions with leverage up to 125x on cryptocurrencies. It offers a range of risk management tools like stop-loss and liquidation protection. While increasing potential profits, high leverage also raises the risk of significant losses, requiring careful strategy and risk control.

Disclosure: To maintain the operation of our site free of charge, we may occasionally earn a small commission if a reader chooses to purchase services through links on our site, at no extra cost to them. Read about disclosure here

Best Crypto Leverage Trading Platforms

Crypto Leverage Trading Platforms allow traders to amplify their positions by borrowing funds to trade larger amounts of cryptocurrency than their initial capital would permit. These platforms offer leverage options ranging from 2x to 100x, allowing traders to increase potential profits. Popular platforms like Binance, Bybit, and OKX provide a wide variety of cryptocurrencies for leveraged trading, such as Bitcoin, Ethereum, and altcoins. They also offer advanced tools like stop-loss orders and margin trading to help manage risk and protect positions from significant losses.

However, while leverage trading can lead to high profits, it also comes with substantial risks. A small price movement in the opposite direction can lead to large losses or even liquidation of positions. This risk makes leverage trading more suitable for experienced traders who understand market dynamics and risk management. For beginners, it’s crucial to thoroughly research and understand the mechanics of leverage before engaging in these trades.

Top Best Crypto Leverage Trading Platforms

Here are the top 6 crypto leverage trading platforms:

1. Binance Leverage Trading

Binance Leverage Trading allows traders to increase their position size by borrowing funds, enabling them to amplify potential profits. By using leverage, even small price movements can lead to substantial gains, offering a chance to maximize returns in volatile markets. Binance offers leverage ranging from 2x to 125x depending on the asset, providing traders with a range of risk/reward options. This flexibility can be appealing to those looking for high-reward opportunities with relatively lower initial capital.

Pros

- Increased Profit Potential: Leverage allows traders to control larger positions than their actual capital, leading to the opportunity for higher profits.

- Market Flexibility: Traders can profit from both rising and falling markets by using long or short positions, broadening trading opportunities.

- Capital Efficiency: Leverage enables traders to access bigger trades with less upfront capital, which could lead to more diverse trading strategies.

- Diverse Asset Choices: Binance offers leverage across a wide range of cryptocurrencies, giving traders numerous markets to engage in.

Cons

- Increased Risk of Loss: Leveraged trades magnify losses just as much as profits, with the potential for rapid liquidation if the market moves against the position.

- Emotional Pressure: The potential for substantial gains and losses can lead to emotional decision:-making, especially for inexperienced traders.

- High Complexity: Leverage trading requires strong knowledge of risk management, and without it, traders can easily lose large portions of their capital.

- Liquidation Risk: With high leverage, even small market moves can trigger automatic liquidation, resulting in the total loss of the invested capital.

THE BEST

Binance leverage trading allows users to borrow funds to trade larger positions than their account balance, amplifying potential profits and risks. It offers leverage from 2x to 125x, enabling traders to maximize returns in volatile markets, but also increasing the possibility of significant losses. Caution is advised.

2. Coinbase Leverage Trading

Coinbase Leverage Trading offers traders the ability to magnify their exposure to cryptocurrency markets by borrowing funds to open larger positions. This allows traders to potentially earn more profits from smaller price movements than they would with their own capital alone. Coinbase’s leverage options are more conservative compared to some other platforms, with leverage typically ranging from 2x to 5x. This lower leverage reduces some of the extreme risks associated with high-leverage trading, making it more accessible to novice traders. However, it also means that traders might need to accept smaller returns on their trades.

Pros

- Lower Leverage Risk: With leverage capped at a more moderate level, the risk of large, uncontrollable losses is reduced compared to higher-leverage platforms.

User-Friendly Interface: Coinbase’s simple and intuitive platform makes leverage trading more accessible, especially for beginners.

Regulated Environment: Being a regulated exchange, Coinbase offers a sense of security and transparency, appealing to traders concerned about platform integrity.

Diversified Trading Options: Coinbase supports a variety of cryptocurrencies, providing traders with multiple assets to choose from for leverage trading.

Cons

- Lower Leverage Limitations: The conservative leverage options mean traders might not be able to fully maximize their profits on larger trades.

- High Fees: Coinbase’s fees can be relatively higher compared to other platforms, which may eat into profits, especially for frequent traders.

- Risk of Liquidation: Even with lower leverage, a poorly managed trade can still result in liquidation if the market moves against the position.

- Limited Advanced Features: Advanced traders may find Coinbase’s leverage trading options and tools somewhat lacking compared to more specialized platforms.

Coinbase leverage trading enables users to trade with borrowed funds, amplifying potential profits or losses. Offering up to 3x leverage on selected assets, it allows traders to increase exposure in the market. However, higher risk comes with increased leverage, requiring careful risk management and understanding of market fluctuations.

3. Bybit Leverage Trading

Bybit Leverage Trading allows traders to amplify their positions using borrowed capital, offering the potential for high profits with smaller initial investments. Bybit offers leverage options ranging from 1x to 100x, making it attractive to traders looking for significant exposure in the market. The platform provides leveraged trading on a variety of cryptocurrency pairs, including Bitcoin, Ethereum, and others. With Bybit’s user-friendly interface and advanced trading tools, experienced traders can execute complex strategies, making it a popular choice for both beginners and professionals. However, the higher leverage comes with increased risks, especially in volatile markets where rapid price fluctuations can result in significant losses.

Pros

- High Leverage Options: Bybit offers up to 100x leverage, allowing traders to maximize their potential returns.

- Advanced Trading Tools: The platform provides features like stop-loss orders and risk management tools to help mitigate potential losses.

- Liquidity and Speed: Bybit is known for its fast order execution and high liquidity, ensuring smooth trading experiences even with large positions.

- Wide Range of Crypto Pairs: Bybit offers a broad selection of cryptocurrencies for leveraged trading, appealing to traders looking for diverse opportunities.

Cons

- High Risk of Liquidation: With high leverage, even small price movements can trigger liquidation, causing significant losses.

- Complex for Beginners: While advanced tools are beneficial, they may overwhelm novice traders who are not familiar with leverage trading.

- High Fees for Frequent Trading: Active traders may face relatively high fees, which can reduce profitability over time.

- Emotional Stress: Leverage trading can lead to emotional decision-making, especially during periods of market volatility.

Bybit leverage trading allows users to borrow funds to trade larger positions, with leverage up to 100x on cryptocurrencies. This amplifies potential gains but also increases risk. The platform offers advanced tools like stop-loss and take-profit orders to manage risk, making it essential for users to trade cautiously.

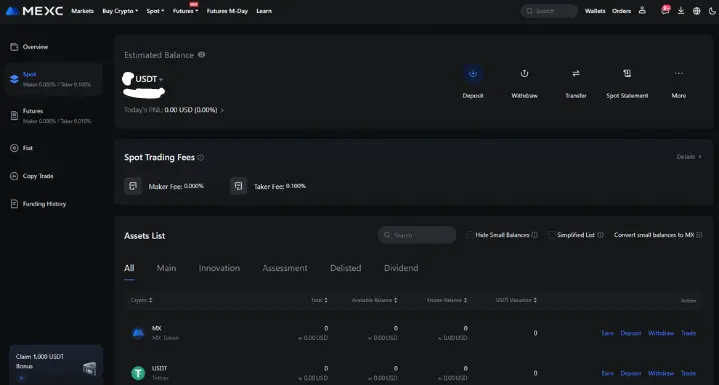

4. MEXC Leverage Trading

MEXC Leverage Trading allows traders to use borrowed funds to enhance their positions, providing the opportunity to amplify profits in the highly volatile cryptocurrency market. With leverage options ranging from 1x to 125x, MEXC caters to a wide range of traders, from those seeking more cautious strategies to those who prefer aggressive leverage. The platform offers a variety of cryptocurrencies for leveraged trading, including Bitcoin, Ethereum, and altcoins. MEXC’s intuitive interface and various trading tools allow both beginners and experienced traders to effectively manage leveraged positions. However, the high leverage also introduces substantial risks, particularly in volatile market conditions.

Pros

- Wide Leverage Range: MEXC offers leverage up to 125x, enabling traders to maximize their exposure to the market.

- Multiple Cryptocurrency Pairs: The platform provides leverage across a diverse range of crypto assets, catering to different trader preferences.

- Advanced Risk Management Tools: MEXC offers features like stop-loss and take-profit orders, helping traders manage risk effectively.

- Intuitive Interface: The platform is simple to use, making it accessible for both newcomers and experienced traders.

Cons

- Risk of Liquidation: High leverage increases the chance of liquidation if the market moves unfavorably, leading to significant losses.

- Emotional Pressure: The potential for large profits and losses can lead to emotional decision-making, especially for inexperienced traders.

- High Volatility Risk: Crypto markets are known for rapid price swings, which can trigger forced liquidation in highly leveraged trades.

- Fees on Leveraged Trades: MEXC charges fees on leveraged trades, which can eat into profits, especially for high-frequency traders.

MEXC leverage trading lets users borrow funds to trade with higher positions, offering up to 125x leverage on selected cryptocurrencies. This enhances profit potential but also increases risk. The platform provides tools like stop-loss and margin calls to help manage risk, requiring users to trade responsibly.

5. BingX Leverage Trading

BingX Leverage Trading allows traders to amplify their positions by borrowing funds, which increases both potential profits and risks. With leverage options ranging from 1x to 100x, BingX provides a variety of choices for traders looking to optimize their market exposure. The platform supports leveraged trading across a range of popular cryptocurrencies, including Bitcoin and Ethereum, and offers features like real-time charts, stop-loss, and take-profit orders. While these features cater to both beginners and advanced traders, the leverage available can also lead to significant risks, particularly if the market moves unfavorably.

Pros

- High Leverage Options: BingX offers leverage up to 100x, allowing traders to magnify potential profits on their trades.

- Advanced Trading Tools: The platform provides features such as stop-loss and take-profit orders, enabling better risk management.

- User-Friendly Interface: BingX is known for its intuitive and easy-to-navigate platform, which is beneficial for novice traders.

- Diverse Cryptocurrency Pairs: BingX supports multiple cryptocurrencies for leveraged trading, providing traders with various options to diversify their portfolios.

Cons

- Risk of Liquidation: High leverage increases the risk of liquidation if the market moves against the trader’s position.

- Complexity for New Traders: Leverage trading can be overwhelming for beginners without a solid understanding of risk management.

- Market Volatility: Cryptocurrency markets are known for their extreme volatility, which can trigger rapid liquidation in leveraged positions.

- Fees: Trading with leverage on BingX involves additional fees, which can reduce overall profitability, especially for frequent traders.

BingX leverage trading allows users to trade with borrowed funds, offering leverage up to 50x on crypto pairs. This amplifies both profits and risks. The platform features risk management tools like stop-loss and take-profit orders, encouraging users to trade cautiously and manage potential losses effectively.

6. OKX Leverage Trading

OKX Leverage Trading offers traders the ability to borrow funds and amplify their positions, allowing them to potentially earn greater profits from price movements in the cryptocurrency market. With leverage ranging from 1x to 100x, OKX caters to both conservative and aggressive traders. The platform supports a wide range of cryptocurrencies for leveraged trading, including Bitcoin, Ethereum, and various altcoins. OKX also provides advanced trading tools, such as margin trading, stop-loss, and take-profit orders, which help traders manage their positions. However, the potential for high profits also brings high risk, especially during periods of market volatility.

Pros

- Wide Range of Leverage: With leverage options up to 100x, traders can amplify their market exposure and potential returns.

- Advanced Risk Management Tools: OKX offers tools like stop-loss orders, helping traders manage risks more effectively.

- Diverse Cryptocurrency Selection: The platform supports numerous crypto pairs for leveraged trading, providing traders with plenty of options.

- Liquidity and Speed: OKX’s platform provides fast order execution and high liquidity, ensuring smooth trading even for large positions.

Cons

- High Liquidation Risk: The higher the leverage, the greater the risk of liquidation if the market moves against the position.

- Emotional Strain: The potential for significant gains or losses can cause emotional decision-making, especially in volatile markets.

- Complexity for Beginners: Leverage trading can be overwhelming for new traders without a strong understanding of market dynamics.

- Trading Fees: Leverage trading on OKX incurs additional fees, which can diminish profits, particularly for frequent traders.

OKX leverage trading enables users to amplify positions with leverage up to 125x on cryptocurrencies. It offers a range of risk management tools like stop-loss and liquidation protection. While increasing potential profits, high leverage also raises the risk of significant losses, requiring careful strategy and risk control.

Conclusion

In conclusion, crypto leverage trading platforms offer traders the opportunity to amplify their positions and potentially increase profits, but they also come with significant risks. The platforms discussed—such as Binance, Bybit, OKX, and others—each provide different leverage options, ranging from moderate to high, allowing traders to select the level of risk they are comfortable with. Advanced tools like stop-loss orders, margin trading, and real-time charts help traders manage their positions, which is crucial when dealing with high volatility in the crypto market.

However, it’s important to remember that leverage trading is not suitable for everyone. While the potential for profits can be enticing, the risk of liquidation and substantial losses is real, especially for inexperienced traders. For beginners, it is essential to understand the fundamentals of leverage, risk management strategies, and the intricacies of market movements before engaging in leveraged trading. Experienced traders may benefit from the flexibility and tools provided by these platforms, but they must also be prepared to manage the emotional and financial risks that come with it. In the end, successful leverage trading requires knowledge, discipline, and a clear risk management plan to navigate the high-stakes world of crypto markets.

Our Top Recommended Leverage Trading

Subscribe to our Newsletter

Receive the latest updates on cryptocurrency news directly to your inbox.

(Your privacy is important to us.)

Frequently Asked Questions (FAQs)

Crypto leverage trading allows traders to borrow funds to increase the size of their positions, enabling them to control larger amounts of cryptocurrency with less capital. For example, 10x leverage means you can control $10 worth of crypto with just $1 of your own funds.

Leverage amplifies both potential profits and losses. If the market moves in your favor, profits are increased; if it moves against you, losses are magnified. For instance, with 5x leverage, a 10% price increase results in a 50% profit, but a 10% drop leads to a 50% loss.

Leverage increases the potential for significant losses. If the market moves against your position, you could lose more than your initial investment and may be forced to liquidate your position to cover the losses.

Liquidation happens when your margin balance falls below the required threshold due to losses on your position. The platform automatically closes your trade to prevent further loss, which means you lose your margin and could incur additional fees.

Leverage trading is not recommended for beginners due to its high-risk nature. It’s essential to understand market dynamics, risk management strategies, and how leverage works before using it in trading.

Popular platforms for crypto leverage trading include Binance, Bybit, Binance, and MEXC. Look for platforms with strong security features, competitive fees, and good risk management tools.