Track real-time price movements of the Gold USD/USD pair with this live, easy-to-use chart. Stay updated on the latest market value and observe price trends as they unfold.

Use the chart to analyze historical exchange rates, assess market dynamics, and enhance your trading decisions. It’s a valuable tool for building and refining your gold trading strategy.

About XAU/USD Gold

XAU/USD is the symbol for the trading pair that represents the value of one troy ounce of gold quoted in US dollars. Gold (XAU) is a precious metal with intrinsic value, widely considered a safe-haven asset during economic uncertainty, inflation, or market volatility. The XAU/USD pair is heavily traded in both forex and commodities markets, offering investors opportunities for speculation, hedging, and portfolio diversification. Gold prices are influenced by factors like interest rates, geopolitical tensions, and the strength of the US dollar. Monitoring the XAU/USD pair helps traders analyze gold’s performance and make informed investment decisions in real time.

Staticcs For Gold

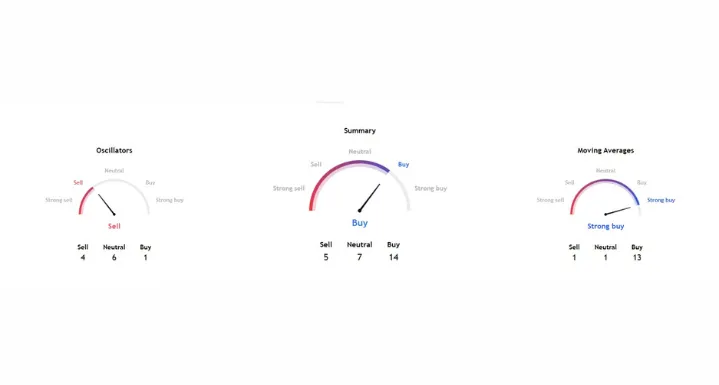

Technical analysis for XAU/USD involves studying price charts, trends, support and resistance levels, and indicators like RSI or MACD to forecast potential gold price movements against the US dollar.

XAUUSD Historical Seasonality (Chat)

Gold (XAUUSD) shows clear seasonal patterns, often rising in January and from August to December. These trends are driven by increased demand during festive seasons, inflation concerns, and central bank activity. Traders use this historical data to anticipate potential price movements and align strategies accordingly.

XAUUSD Historical Seasonality (Table)

This table shows typical monthly trends in XAUUSD based on historical data. Patterns reflect demand shifts, investor sentiment, and global economic cycles.

Conclusion

The XAU/USD currency pair, representing the price of gold in U.S. dollars, remains one of the most closely watched markets in global finance. Gold has long been considered a safe-haven asset, with its value often rising during periods of economic uncertainty or geopolitical tension. As a commodity, its price is influenced by a variety of factors, including interest rates, inflation, global economic growth, and shifts in investor sentiment.

In recent years, the price of gold has been highly responsive to the actions of central banks, particularly the Federal Reserve, as changes in interest rates directly affect the opportunity cost of holding non-yielding assets like gold. Furthermore, macroeconomic factors such as inflationary pressures and currency fluctuations also play a significant role in determining its market price.

Overall, the XAU/USD pair offers valuable insights into global economic health and investor risk appetite. Traders and investors alike must stay attuned to these economic indicators and geopolitical events to effectively navigate the gold market. The volatility inherent in this market presents both opportunities and risks, making it essential for participants to employ disciplined risk management strategies when trading gold.

Frequently Asked Questions (FAQ)

What is XAU/USD?

XAU/USD shows how much one troy ounce of gold is worth in US dollars. It’s a trading symbol used in forex and commodities markets where “XAU” is the international code for gold and “USD” is the US dollar.

How is XAU/USD traded?

XAU/USD is typically traded as a CFD (Contract for Difference) or spot price in forex markets. Traders speculate on price movements without owning physical gold.

What factors influence XAU/USD prices?

Key factors include:

* US dollar strength or weakness

* Inflation and interest rates

* Central bank policies

* Geopolitical tensions and market risk sentiment

* Demand from jewelry, industry, and investors

What are the trading hours for XAU/USD?

XAU/USD is traded nearly 24 hours a day, 5 days a week, in line with global forex market hours (typically Sunday evening to Friday evening, UTC).

Why trade XAU/USD?

Traders use XAU/USD to hedge against inflation, diversify portfolios, or capitalize on market volatility. It is known for strong liquidity and its inverse correlation with the US dollar.

Disclosure: To maintain the operation of our site free of charge, we may occasionally earn a small commission if a reader chooses to purchase services through links on our site, at no extra cost to them. Read about disclosure here

Investment Disclaimer: The views expressed are those of the author and based on current market conditions. Please perform your own research before investing in cryptocurrencies. Neither the author nor the publication assumes responsibility for any financial losses incurred.

Best Platforms to Trade Gold XAU/USD

TRUSTED PARTNER BUY GOLD

Subscribe to our Newsletter

Receive the latest updates on crypto news directly to your inbox.

(Your privacy is important to us.)